Of late I have been seeing and considering the many changes in the realm of money.

We should return to the very beginning. I envision that some time before cash was utilized, people sorted out an approach to trade labor and products. Maybe they utilized shells or feathers or different things in nature to monitor exchanges.

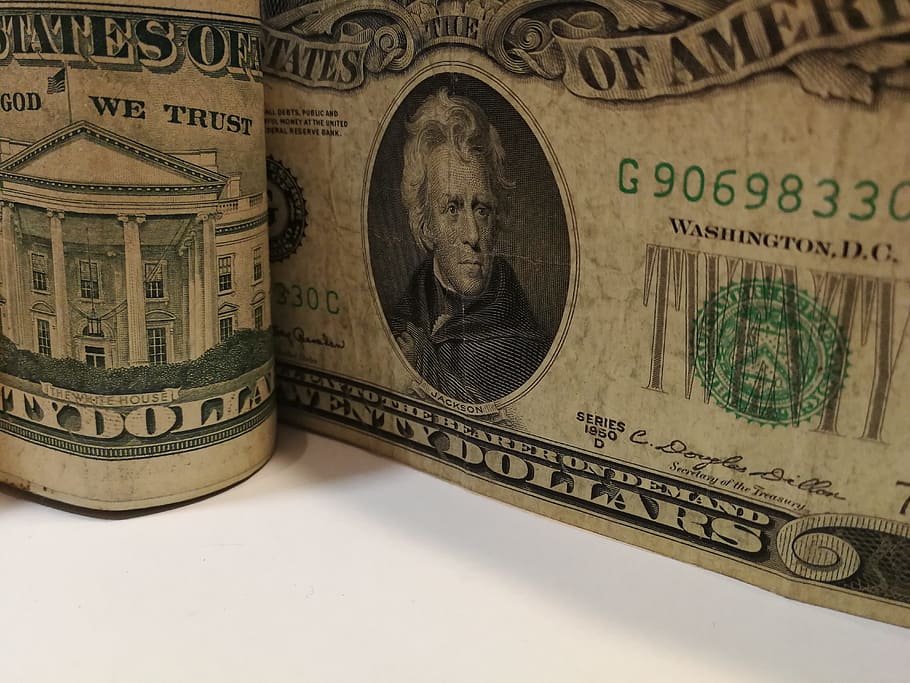

It is accepted that around 5000BC the idea of cash was utilized however it took until 700 BC for social orders to being making coins out of metal. Nations then, at that point beginning stamping the own interesting coins and paper cash in various qualities and plans.

The idea of banking is archived as happening around 2000 BC when vendors would give grain credits to ranchers so they could plant crops and to merchants who might do the shipping of products.

At the point when I grew up, there were banks yet the simplest method to decide our monetary circumstance was to simply placed a hand in the pocket. In the event that it came up void, you realized you were destitute! It was something frightening to consider going to a bank to request help.

I recall, in my pre-adolescent years, when my fatherly granddad urged me to purchase a “bond” with the goal that I could help the nation and acquire interest through coupon cutting. I was acquainted with procuring through venture.

In 1946 the Visa was presented in North America. That made a huge difference! Out of nowhere, individuals could purchase things without having the cash front and center. In the event that you paid the base due on schedule, your cutoff was expanded. Individuals moved their intuition from first having cash to spend it to simply getting sufficient credit to purchase what they needed.

Bank administrations expanded thus intrigued rates just as both individual and cultural obligation.

The Canadian Taxpayers Federation asserts that our current government obligation of $713 billion is presently passing by $878 each second. In case you are ready for a staggering rude awakening search on your PC for debtclock.ca This site shows that each and every a lot of the government obligation this month is just shy of $30,000.00. Also, this is only the government obligation – excluding commonplace or individual obligation.

What’s more, since the pandemic has hampered the economy, governments across North America are printing improvement or helicopter cash. The more they print, the less worth it has. Contemplate what comparative circumstances meant for Germany and Venezuela previously. In the long run the dollar was worth little to such an extent that customers required a full work cart to purchase a portion of bread.

So what are the arrangements? Numerous people and organizations have put resources into the financial exchange. Bits of hearsay anticipate an impending collide due with the issues with the economy and degrading of the dollar. Expanding dread has brought about a quest for different alternatives.

Many are purchasing cryptographic forms of money which are computerized resources with very high instability. Alternatives, for example, Bitcoin, XRP, and Ethereum have been portrayed as the speculation that will transform people into moguls short-term. Skeptics portray cryptographic forms of money as air that is filled by the desire for financial backers and can vanish with the snap of a catch.

Another gathering has been purchasing actual valuable metals like gold and silver. Maybe than getting them as paper stocks or stowing away them vaults they are holding them in close to home safes. They utilize recorded patterns to back up their expectation that the cost will detonate as the worth of the dollar diminishes.

Different wares like timber, copper and agrarian items are additionally being considered as savvy decisions as costs are quickly rising.

Presently I am certainly not a monetary master and have no goal of offering guidance regarding how to contribute. I am, in any case, a Registered Psychologist who realizes that an individual’s “rest factor” is significant. Dread and high danger can hurt both your physical and emotional well-being.

In this period of progress, ensure that you center around what you can handle and not on things you can’t handle. Do great exploration prior to making any move. Breaking point the measure of information you have from “talking heads” who express feelings instead of realities.